STOCK MARKETS OF ASIA 2009 TO 2017

There have been comments that one of the reasons for the apparent reluctance of Australian corporates, funds and individuals to invest in Asia has been that the Asian stock markets are not sufficiently profitable. An analysis of the financial performance and outcomes of 6 Asian based stock markets and for comparison 5 western markets including Australia has been undertaken to evaluate the position. The results are consistent with the findings of a similar analysis undertaken last year that selected Asian markets are producing excellent performances when compared to selected western markets.

Glen Robinson & Trevin Susanto

AFG Venture Group

+61 412 229 664

[email protected]

About the Authors

Glen Robinson’s experience and expertise lie in the manufacturing, processing and distribution areas, with specific emphasis on business management and strategic planning. Glen has more than 25 years’ experience in management consultancy and has worked with a wide range of industries from agriculture through to manufacturing and distribution industries providing advice and assistance to those organisations which wished to establish or enhance a commercial presence in ASEAN. He initially gained his South East Asian experience as chief executive officer for the Asian subsidiaries and joint ventures of a major International manufacturing and marketing organisation. Glen has been on the boards of many Asian related business organisations and has for many years advised a number of Foreign Investment Boards in the ASEAN region. He has a great range of contacts in both business and government in the region

Trevin Susanto is an intern for AFG Venture Group. Originally from Jakarta, currently based in Sydney and completing an undergraduate degree in Business Economics from City University of Hong Kong. He is naturally curious about economics, social issues, education, politics, science and art. His expertise was applied to the analytical aspects of this project

Disclaimer

The information in this paper is for general information purposes only. It is not intended as legal, financial or investment advice and should not be construed or relied on as such. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered legal practitioner or financial or investment adviser. No material contained within this report should be construed or relied upon as providing recommendations in relation to any legal or financial product. AFG Venture Group does not recommend or endorse any investments or products and does not receive remuneration based upon investment or other decisions by our email recipients, publications, newsletter or website users.

INTRODUCTION

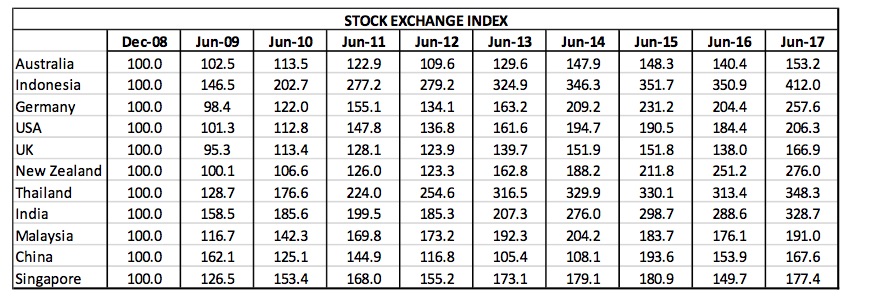

Many of the stock exchanges of Asia have been rapidly developing and attracting significant interest as well as providing capital for both corporate and national development. The ASEAN Exchanges [www.aseanexchanges.org] developed by the ASEAN Secretariat is now well established and has 7 exchanges operating effectively, and the other ASEAN based exchanges are preparing to join. The ASEAN Exchanges was established to provide collaboration within the ASEAN region, focusing on harmonising regulatory frameworks, facilitating the issuance of ASEAN products, cross-exchange listing of ASEAN products and mutual recognition of capital market professionals.

In 2016 an analysis of the investments and returns from selected stock exchanges in the Asian region was undertaken, and in this 2017 overview the region is re-visited and an update to the original information is presented.

For this analysis the information from 6 Asian and 5 western exchanges is reviewed as follows:-

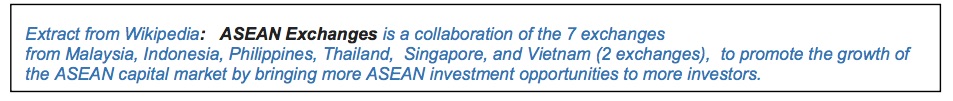

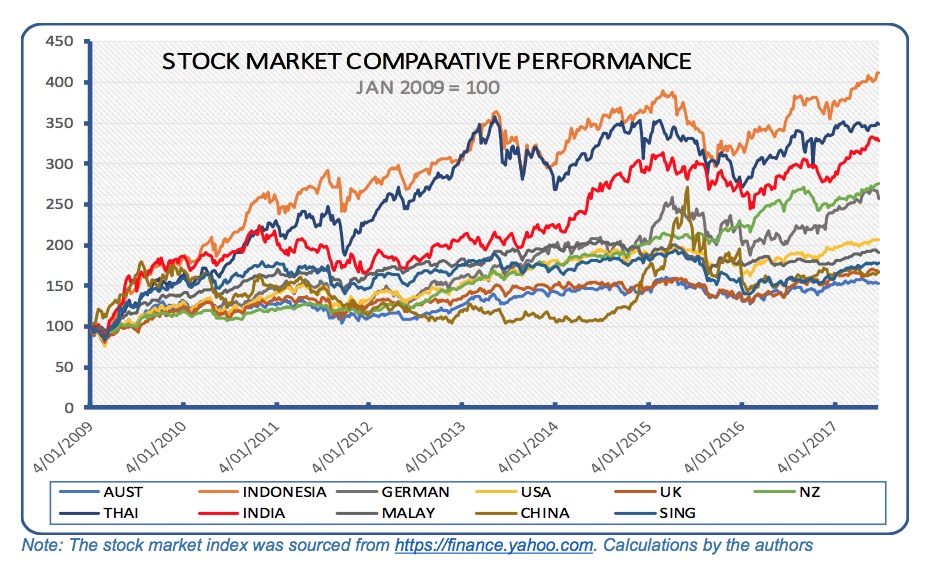

STOCK MARKET HISTORICAL PERFORMANCE

In order to provide an analysis covering an extended period, the indexes for the selected stock exchanges for the period from the end of the Global Financial Crisis, 1st January 2009 to the end of financial year, June 2017 have been plotted weekly are shown in the following graphic. With the 1st January 2009 taken as 100, the changes from that point in the weekly index for each exchange are shown.

The tabular form of the index is shown in the following table, and once again Jan 1, 2009, is taken as 100, and the relative index for the end of June for each of the subsequent years is shown.

This demonstrates that on average the selected Asian markets had a higher capital growth than that of the western or Australian exchanges.

DIVIDENDS

Considerable comment is made in other presentations that the Dividends paid out in Australia are much higher than the global average. In this analysis, the view has been taken that the dividend payout is a factor in the attractiveness of the stock and therefore can be seen as being included as a fundamental part of the stock value.

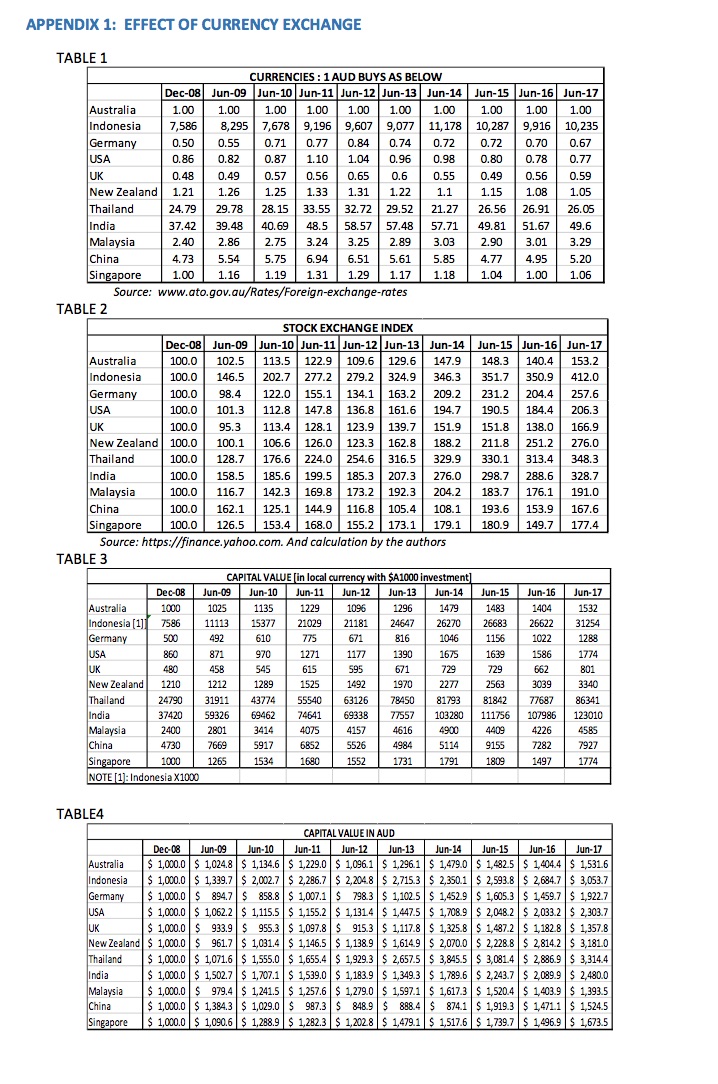

THE EFFECT OF CURRENCY FLUCTUATIONS

The variability in the currency valuations can significantly affect the capital returns when currency is moved across borders, and naturally, create both a positive or negative effect for investors. An analysis has undertaken to show the combined effect of the stock market fluctuations and the change in the currency exchange rate in the individual countries under analysis.

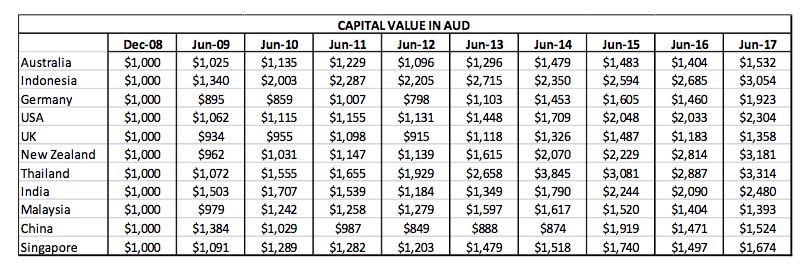

The analysis assumes that $A1000 capital is invested on Jan 1, 2009 and then shows the combined effect of stock market index changes as well as the changes in the relative value of the AUD as at June each year. The calculation is shown as Appendix 1 and a summary is shown in the following table.

The capital value of the original $A1000 investment at June 30 each year is shown and is expressed as AUD at the relevant exchange rates. The value includes the stock market index and the value of the currency, but it does not include share splits, taxation and brokerage costs.

CORPORATE TAXATION

Corporate taxation can have a significant effect on the net return to the investor if a cross border transaction is undertaken. However, Australia has Double Tax Agreements [DTA] with 45 countries which prevents the payment of double taxation, that is taxation in both countries on the same transaction. The details of the individual DTAs may vary, so a specific review is required. Appendix 2 shows the countries with which Australia has a DTA.

INVESTING OFF-SHORE

In the 2016 analysis, a commentary was included which outlined the experience of the author in investing off shore. Contrary to the commonly held belief, that experience demonstrated that the process is not onerous, and as can be seen by this analysis the capital returns can be quite considerable, so for the sake of completeness the paragraph is repeated here in full

Westerners are often reluctant to invest into the off-shore stock markets as “conventional wisdom” says the process is too difficult, with the currency differences, the various tax regimes, the lack of knowledge or information on investment targets, and the perceived distrust of foreign financial schemes. However, all those issues and concerns may be overcome quite easily. I will relate my experience in investing in a foreign stock market, as I was extremely pleased with the process and end result. I hasten to add that I am not authorised to provide advice, so I am only recounting my own experience, and I do not imply that this is general, as each person has different expectations and aspirations.

I selected a country in South East Asia in which to invest, selected a broker/advisor company which had a number of offices throughout the region, and also opened a bank account in my home country which I used exclusively for trading purposes. At a meeting with the assigned executive in the broking company, my investment profile and aspirations were established, as was the initial investments.

On returning home [Australia] I transferred the cost of the initial investment from my designated bank account to the account of the broking company all in AUD. From then on I received a monthly statement of my holdings, including market value, I received a cheque [in AUD] and a statement whenever a transaction or dividend occurred, and a weekly statement on the state of the market and the economy [usually ran to 10-15 pages]. I also received advice on sales and purchases of stock on which I made the final decision in relation to hold, buy or sell. The overall information provided was excellent, and the process was simple.

WHY IS THIS SO?

Why are the Asian stock markets enjoying capital growth which exceeds that of Australia? The answer to that question lies outside the parameters of this analysis, and may well be the subject of a further analysis. It is imagined that many theories will be postulated as to the reasons and these may include, the growth rates of the various economies, the level of governance, the ability of the corporate management, the relative exchange rates, and of course there may be others.

CONCLUSION

It is apparent that the Asian stock markets are developing and enjoy significant capital growth with a high degree of probity, and consequently satisfactory returns for individuals and institutional investors. It is highly probable that not all countries offer the same level of capital growth or dividend outcomes, however, it is apparent that a public listing of an off-shore investment may be a viable option to be seriously considered.

The apparent relative poor performance of selected markets may be of concern, as it may warrant comment on the quality or competence of company management and strategy, but of more concern is the effect it may have on the perceived attractiveness of the Australian stock market to those investors, both foreign and local.

FOR CONSIDERATION

Glen Robinson &

Trevin Susanto