The stock market is often held up as one of the indicators of the health and robustness of an economy and may be used as a comparison between various economies. The newer economies in Asia often attract comment, some of it derogatory particularly in relation to the performance of the stock markets, and an analysis or overview of the actual stock market performances, particularly over time can prove to be useful and enlightening. This analysis is another in a series in which the longer-term performance of the Australian stock market is compared with both selected Asian and western markets, and the results are reasonably consistent over time. They consistently depict Australia’s performance as less than stellar, when the common perception is that the Australian market is held out to be an excellent performer, and the performance of some of the Asian markets is surprisingly good and could offer interesting investments for some.

Glen Robinson

AFG Venture Group

+61 412 229 664

About the Author

Glen Robinson’s experience and expertise lie in the manufacturing, processing, and distribution areas, with specific emphasis on business management and strategic planning. He has more than 35 years’ experience in management consultancy and has worked with a wide range of industries from agriculture through to manufacturing and distribution industries providing advice and assistance to those organisations which wished to establish or enhance a commercial presence in ASEAN. He initially gained his South East Asian experience as chief executive officer for the Asian subsidiaries and joint ventures of a major International manufacturing and marketing organisation. He is a co-founder and director of Asean Focus Group which was established in 1990 and had traded for many years as AFG Venture Group.

Glen has been on the boards of many Asian related business organisations and has for many years advised a number of Foreign Investment Boards in the ASEAN region. He has a great range of contacts in both business and government in the region.

Disclaimer The information in this paper is for general information purposes only. It is not intended as legal, financial or investment advice and should not be construed or relied on as such. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered legal practitioner or financial or investment adviser. No material contained within this report should be construed or relied upon as providing recommendations in relation to any legal or financial product.

AFG Venture Group does not recommend or endorse any investments or products and does not receive remuneration based upon investment or other decisions by our email recipients, publications, newsletter, or website users.

INTRODUCTION

The performance of the Asian stock markets has been improving over the last decade, but it should be noted that Asia consists of 47 countries, depending on how it is counted. These countries are diverse in most aspects, for example, level of development, population, ethnicity, religions, and language. Many commentators say that Australia should be included in any discussion on Asia, as we are an integral part of it.

So, while this analysis is essentially about Asia, several Asian countries have been selected for analysis, together with several western countries for comparative purposes.

Commentators often claim that Australia’s stock market is a booming place in which to invest compared to the Asian stock markets mainly because there is a significant question mark in relation to overall performance of the Asian markets. Is this a fair comment? To respond to that question, an analysis of the performance of stock markets, across 12 economies and covering 11 years has been prepared.

PERFORMANCE INDICATOR

The performance of the stock markets has been defined as the change in the closing sale price on a weekly basis for each of the years from 2009 to 2020. The year 2009 was selected as the starting point as that was at the end of the GFC, and the weekly index was calculated from the following formula: –

Weekly index = Weekly Closing Price x 100

Closing price for the first week in 2009

In this analysis the bourses compared to and in addition to the Australia ASX 200 are

Australia’s investment partners

New Zealand NZX 50

United States S&P 500

Asean Exchange markets selected.

Indonesia JKSE

Thailand SET 50

Singapore SPDR STRAITS TIMES INDEX

Philippines

Others

Germany German DAX

China SSE Composite Index [0000001.SS]

India BSE SENSEX

Japan [EWJ

Hong Kong

AUSTRALIAS HISTORICAL INVESTMENT

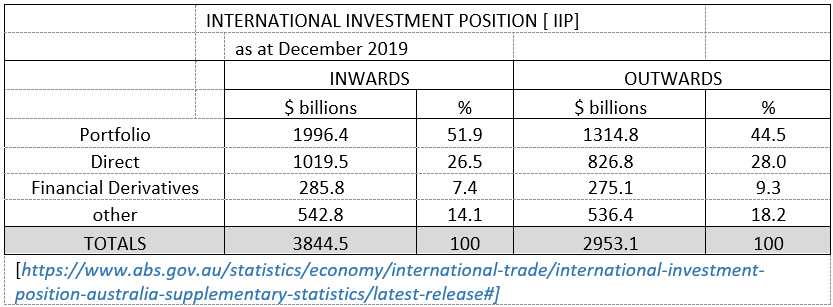

Australian offshore investment pattern has materially changed over the years, with portfolio investment increasing as a percentage of the total. In 2003 it was 34% and in 2015 the portfolio portion had grown to 39% of the total, and by 2019 the outward portfolio was 44.5% of the total. Similarly, the outward Foreign Direct Investment [FDI] has declined as a percentage of the total. However, only a small proportion of that is directed to Asia.

The following table shows the stock of Australian outward and outward foreign investment as at end of December 2019. The inward foreign investment is 30% higher than the outward foreign investments made by Australian organisations.

ASEAN EXCHANGES

The development of the Asean Exchanges [www.aseanexchanges.org] has been quite a successful venture in capital raising. It was established in 2012 by the Asean Secretariat to foster the growth of the Asean capital market through harmonising the systems; streamlining access to the Asean market; improving efficiency of the Asean exchanges; and hopefully creating Asean products. It was formed initially with 7 exchanges from Malaysia, Vietnam (2 exchanges), Indonesia, Philippines, Thailand and Singapore. It has not expanded to cover other exchanges, but it has fostered the growth of world class brokers which service multi countries and multi exchanges, and these brokers provide an excellent service. The Exchanges has also seen the growth of Asean companies which cover multiple countries.

STOCK MARKET HISTORICAL PERFORMANCES

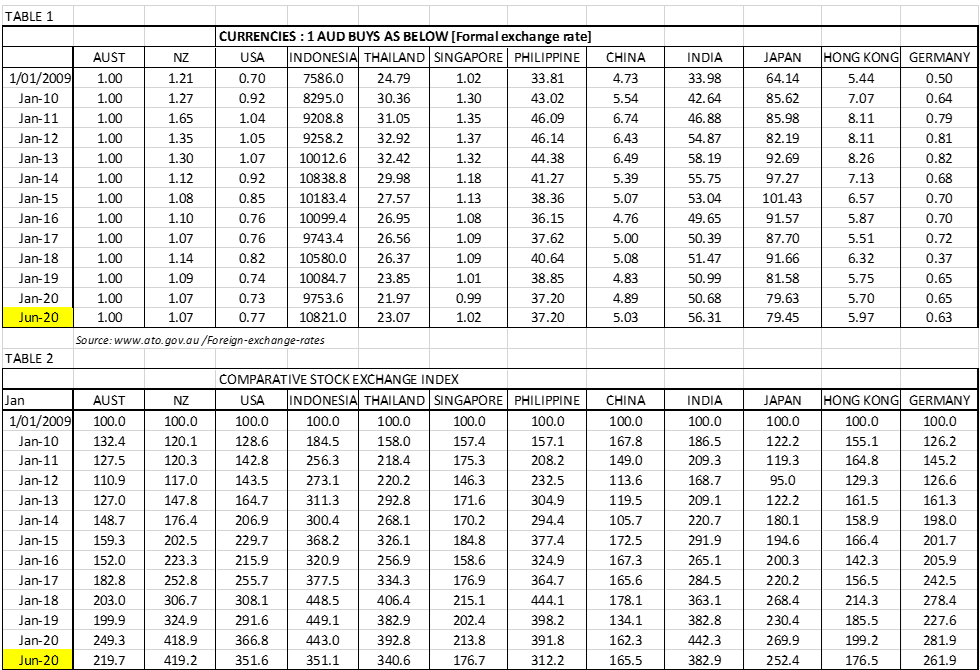

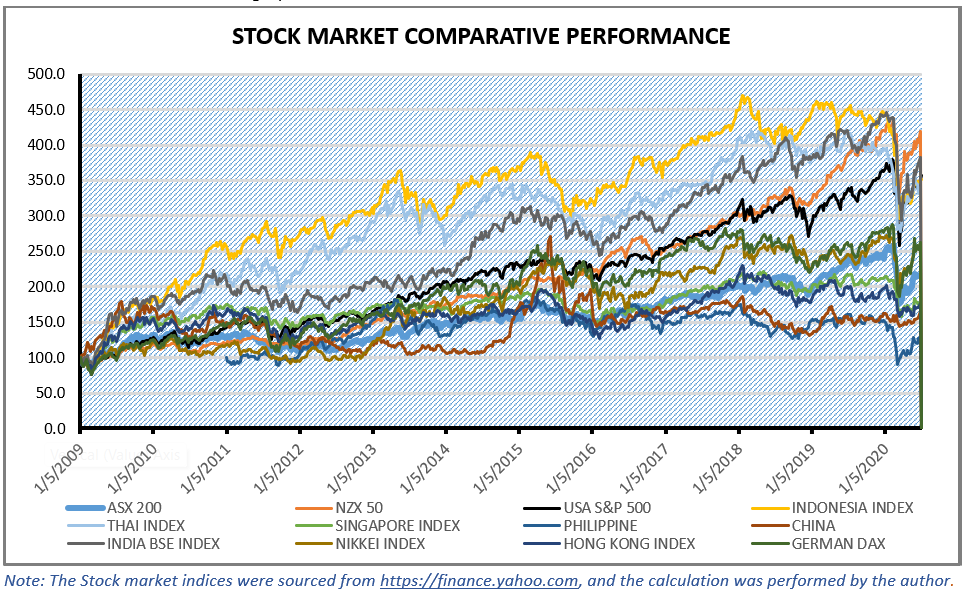

The performance of the stock markets is evaluated based on the index but share splits and dividend payouts have been included. The initial index starting point has been selected as 1 Jan 2009, which is generally regarded as the end of the Global Financial Crisis. This index was taken as 100 and the weekly comparison with that index through to June 2020 has been calculated and graphed as follows.

This is custom heading element

The disruption and confused results which are observed from the beginning of early 2020 are as a consequence of the Covid Virus so those results post June 2020 are ignored.

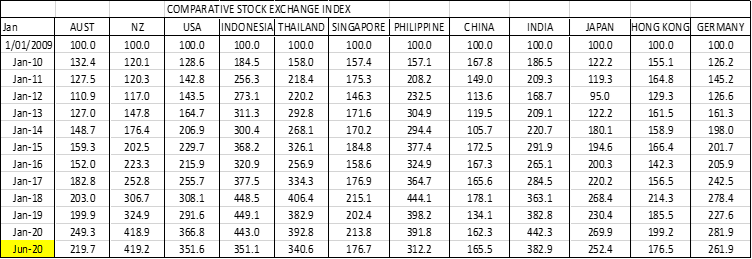

The stock exchange indices are quite interesting as they are show the base performance of the bourse without the interference of currency exchanges. Therefore, the tabular form of the various indices each at the beginning of the calendar year, is shown in the following table.

The analysis shows that the Australian stock market performed at approximately the same level as Singapore, China, Japan and Hong Kong up to the beginning of 2020, but was significantly outperformed by most of the other exchanges. It is noted that the markets in New Zealand, Indonesia, Thailand, and India seem to have performed particularly well up to the beginning of 2020 when the confusion and disruption occurred. It is interesting that there is no perceptible regional bias on performance, but it is notable that the Australian ASX does not present a stellar performance and it may well be considered a very lack lustre performance.

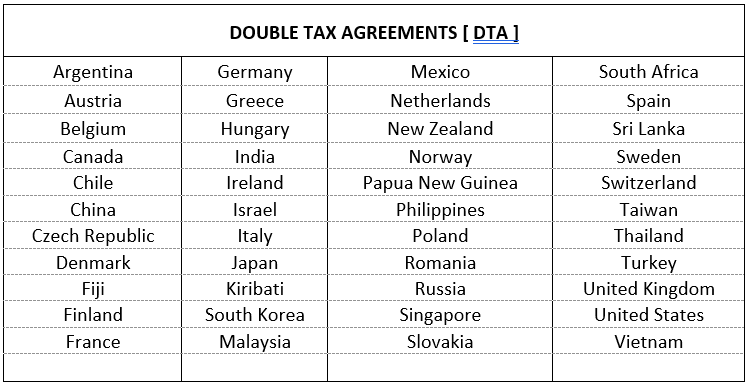

TAXATION

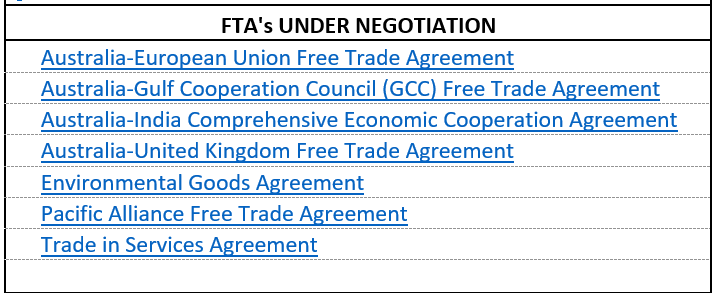

Taxation can have a significant effect on the net returns to the investor, both corporate and personal. Australia has Double Tax Arrangements [DTA’s] with at least 45 countries or territories, and a list is included as an Appendix 1, Australia also has Free Trade Agreements [FTA’s] with a number of countries and this list is included as Appendix 2.

As the terms and conditions for each may vary specific advice should be sought prior to making investment arrangements.

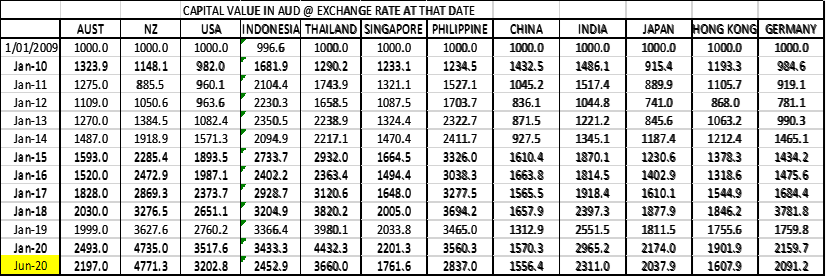

EFFECTS OF CURRENCY FLUCTUATIONS

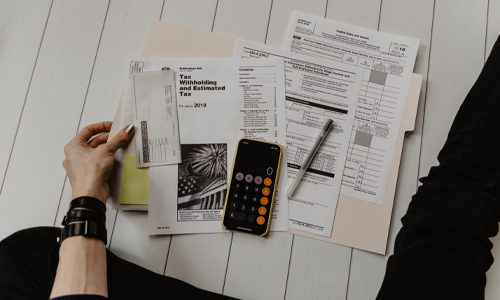

The currency fluctuations, in both the Australian and the target market can have significant effects on the value of the investment when it is moved across borders. An analysis has been made to show the potential of the combined stock market fluctuations and the changes in the currency exchange rate in the individual countries and assumes that $A1000 is invested on Jan 1, 2009 in the selected stock market, and then shows the combined effect on the index changes as well as the changes in the relative value of the AUD in January of each subsequent year. The analysis is included as Appendix 3, and a summary is shown in the following table.

It is noted that an investment on the Australian bourse in the 1st week of January 2009, over time is outperformed by most of the other bourses, the reasons for this are unclear, and certainly outside the scope of this analysis, but it may be a significant factor in both individual and corporate investment considerations.

THE OFFSHORE INVESTMENT PROCESS

To invest on an offshore stock exchange as a corporation, specific advice should be sought as the inward investment regime may vary country to country and any action taken should comply with Australian requirements.

In a previous analysis, a commentary was included which outlined the experience of the author in making an offshore investment. Contrary to the commonly held belief, the experience demonstrated that the process is not onerous and as can be seen by this analysis the capital returns can be quite considerable, so for the sake of completeness the paragraph is repeated here in full.

Westerners are often reluctant to directly invest into the offshore stock markets as “conventional wisdom” says the process is too difficult, with the currency differences, the various tax regimes, the lack of knowledge or information on investment targets, and the perceived distrust of foreign financial schemes. However, all those issues and concerns may be overcome quite easily. I will relate my experience in investing in a foreign stock market, as I was extremely pleased with the process and result. I hasten to add that I am not authorised to provide advice, so I am only recounting my own experience, and I do not imply that this is general, as each person has different expectations and aspirations.

I selected a country in South East Asia in which to invest, selected a broker/advisor company which had a number of offices throughout the region, and also opened a bank account in my home country which I used exclusively for trading purposes. At a personal meeting with the assigned executive in the broking company, my investment profile and aspirations were established, as was the initial investments.

On returning home to Australia] I transferred the cost of the initial investment from my designated bank account to the in-country account of the broking company all in AUD. Thereafter I received a monthly statement of my holdings, including market value, I received a cheque [in AUD] and a statement whenever a transaction or dividend occurred, and a weekly statement on the state of the market and the economy [usually ran to 10-15 pages]. I also received advice on sales and purchases of stock on which I made the final decision in relation to hold, buy or sell. The overall information provided was excellent, and the process was simple.

SUMMARY

This analysis covers 2 main issues.

Firstly, that the stock markets of Asia are performing reasonably well, and probably in accordance with international expectations. While the analysis covers only 8 of the potential 45+ markets, there is sufficient diversity to satisfy most commentators that the performance of the market is acceptable, and probably reflects a result similar to the remainder of the market. It is reasonably clear that there are Asian markets which can compete with the world leaders and there are those which are poor performers.

Secondly, the analysis demonstrates that the Australian returns from a stock market investment may not be as profitable as expected, as the results are in the lower section of this analysis. This is not as expected as the “conventional wisdom” within Australia is that the stock market returns are quite high, but the actual reasons should be the subject of a further analysis, as the reasons are outside the scope of this analysis.

APPENDIX 1: DOUBLE TAX AGREEMENTS

APPENDIX 2: FREE TRADE AGREEMENTS

APPENDIX 3: CALCULATION OF STOCK MARKET MOVEMENT WITH BOTH INDEX AND CURRENCY CHANGES INCLUDED